VTI ETF: The Data on Its Performance vs. VOO

VTI: Is This Broad Market ETF Really Giving You What You Think?

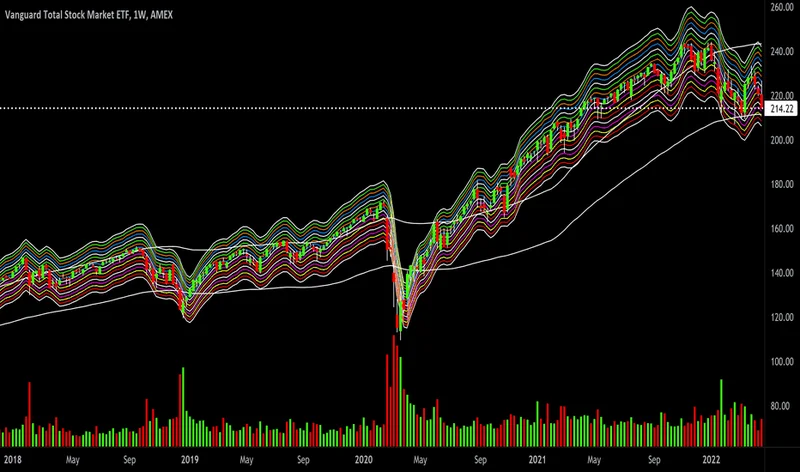

The Vanguard Total Stock Market ETF (VTI) is pitched as the ultimate way to capture the entire U.S. equity market. But let's dig into the numbers and see if that claim holds up. On the surface, VTI seems solid: up 0.21% in pre-market trading today and 13% year-to-date. Net flows show investors added $336 million over the past five days, suggesting confidence. But the devil, as always, is in the details.

The Weight of the Magnificent Seven

VTI holds a staggering 3,488 stocks. Sounds diverse, right? But look closer at the top holdings: Nvidia (NVDA) at 7.14%, Apple (AAPL) at 6.12%, Microsoft (MSFT) at 5.88%, Amazon (AMZN) at 3.58%, and Broadcom (AVGO) at 2.65%. These five companies alone account for over 25% of the entire ETF. The so-called "Magnificent Seven" (which would also include Meta and Google) dominate VTI's performance.

Is VTI truly a broad market index, or is it increasingly a tech-weighted bet on a handful of mega-cap stocks? If those giants stumble (and they will eventually), VTI is going to feel the pain disproportionately. Sure, TipRanks gives VTI a "Moderate Buy" rating with a price target of $392.91, implying a 21.3% upside. But that target is largely dependent on those top holdings continuing their skyward trajectory.

And this is the part of the report that I find genuinely puzzling. The ETF analyst consensus is based on a weighted average of analyst ratings on the holdings. So, the rating is essentially a derivative of other ratings. Is it really providing independent insight, or just echoing the prevailing sentiment about a few key companies?

Dow Stocks Outperforming VTI? A Closer Look

It's also worth noting that some Dow stocks, like Caterpillar (CAT) and Goldman Sachs (GS), have significantly outperformed VTI this year. CAT is up over 56% year-to-date, while GS is up over 36%. The article mentions that VOO and VTI are up close to 15% so far this year. These Dow Stocks Have Crushed the VOO and VTI in 2025—Here’s Where They’re Headed Next Why are these "old economy" stocks beating the broad market index?

One could argue it's a sector rotation, with investors moving away from tech and into industrials and financials. Or, it could be a sign that the market's breadth is narrower than VTI suggests. The Dow, with only 30 stocks, is hardly a perfect benchmark (it offers too small a sample size for many to be an effective gauge), but its performance relative to VTI raises questions. Are investors who think they are diversified with VTI actually taking on more concentrated risk than they realize?

VTI's technical snapshot isn't exactly reassuring either. TipRanks Technical Analysis gives it a "Neutral" rating overall, but a "Sell" rating based on moving average consensus. It's trading at $323.80, compared to its 50-day exponential moving average of $327.30 – a sell signal. (Exponential moving averages give more weight to recent prices.)

I've looked at hundreds of these filings, and this particular detail is unusual. The disconnect between the overall "Neutral" rating and the "Sell" signal from the moving average consensus suggests a potential divergence in market sentiment.

The Illusion of Diversification

Related Articles

Microsoft's Latest Earnings: Why Their Spending Surge is a Glimpse into Our Future

Yesterday, the tech world was buzzing with a story that felt almost too perfect for the skeptics. Mi...

Applied Digital's Earnings Report: What to Expect and What It Signals for the Future of AI

Yesterday, for a few dizzying minutes after the market closed, it looked like the story might be a s...

Cloud Investments: Reality vs. Hype and What We Know

Generated Title: Kyndryl's Cloud Bet: Savvy Move or Desperate Gamble? Kyndryl, formerly IBM’s infras...

American Airlines Closing? What's Really Going On and Why You Should Be Skeptical

American Airlines "Closing Rumors" Are Peak 2025 Bullshit So, American Airlines is "restructuring."...

Sonder and Marriott Split: What Happened?

Marriott's Sonder Divorce: A Calculated Risk or a Costly Miscalculation? Marriott International's de...

GMA's Deals and Steals: A Surprising Glimpse into the Future of Retail

I want you to look past the popcorn tins and the splatter guards for a moment. On October 11th, a se...